Financial Modeling & Forecasting. Powering Smarter Business Decisions with Strategic Financial Insights

we understand that confident decision-making starts with clarity. That’s why our Financial Modeling & Forecasting service is built to give business leaders the financial visibility they need to make informed, growth-driven decisions. Whether you’re a startup seeking investor funding or a growing company planning long-term strategy, our customized financial models are your compass.

Solution Focused

precision and results

Expericened Team

What We Offer

We don’t believe in off-the-shelf spreadsheets. Our approach is personalized, data-driven, and outcome-focused. Every model we build is tailored to your business goals and industry landscape.

Our Financial Modeling Includes:

Revenue Projections: Forecast sales and income across multiple scenarios.

Cash Flow Analysis: Understand your liquidity in real-time and under pressure.

Cost Modeling: Break down fixed and variable costs to see where your capital is going.

Scenario Planning: Prepare for best-case, worst-case, and most-likely situations.

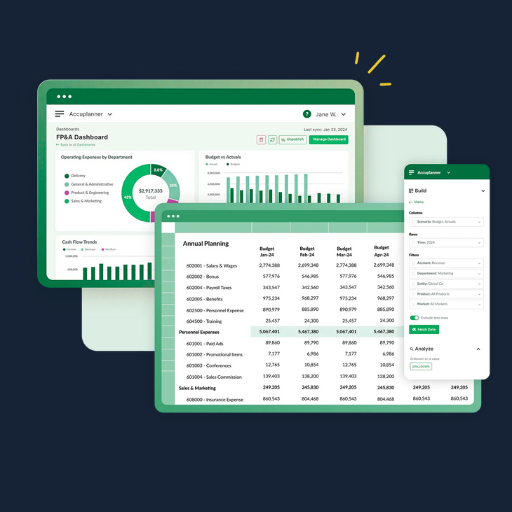

KPI Dashboards: Track what matters most to investors and decision-makers.

Capital Structure Modeling: Visualize your funding needs and options clearly.

Why It Matters

A clear financial roadmap reduces risk, unlocks smarter strategy, and builds trust with investors and stakeholders. Our models are designed to help you:

Make strategic decisions with confidence

Secure capital with credibility

Identify opportunities and inefficiencies

Align operational planning with financial goals

We work closely with your internal finance or leadership team to ensure every assumption is validated and every forecast aligns with your real-world operations.

Who It's For

Our financial modeling and forecasting services are ideal for:

Startups preparing for fundraising rounds

Small-to-medium businesses entering growth phases

Companies planning exits, mergers, or acquisitions

CFOs needing scenario-driven insights

Founders looking to gain control of their numbers

How We Work

-

Discovery & Data Collection: We begin with a deep dive into your business model, goals, and available financial data.

-

Model Building: Our team constructs a dynamic, modular, and easy-to-update model tailored to your needs.

-

Review & Refinement: We walk through the model with you, validate assumptions, and refine forecasts.

-

Delivery & Support: You receive an interactive financial model, plus ongoing support for updates or investor requests.

GT Management Services

Capital Raise Support

Securing funding is competitive — we position you to win. GT Management provides end-to-end capital raise support, ensuring you're fully prepared to pitch, negotiate, and close with investors.

Exit Strategy Planning

Your exit is one of the most critical financial events in your company’s journey. We help you plan proactively and strategically so that when the time comes, you're ready.

Mergers & Acquisitions

GT Management supports both buy-side and sell-side M&A deals, providing thorough analysis, negotiation, and due diligence support.

Governance & Compliance

Strong governance is the foundation of a sustainable, investment-ready company. We help you build compliant, transparent, and effective systems for accountability.

Compensation Modeling

Design compensation plans that balance business goals with employee motivation. Whether you're hiring C-level executives or scaling a sales team.

Let’s Build Smarter Business Foundations

From early-stage strategy to exit, GT Management is your trusted partner in financial clarity, capital access, and operational excellence. Our tailored solutions are designed for founders, executives, and stakeholders who demand precision and results.