Mergers & Acquisitions (M&A). Strategic M&A Support That Protects Value and Unlocks Growth

We understand that every M&A transaction is more than a financial exchange—it’s a pivotal moment of transformation. Whether you’re expanding through acquisition or preparing to sell, we help you navigate the complexity of mergers and acquisitions with precision, insight, and unwavering focus on your long-term success.

We provide end-to-end advisory for both buy-side and sell-side M&A deals, supporting founders, investors, and corporate leadership throughout the transaction lifecycle.

Solution Focused

precision and results

Expericened Team

What We Offer

Our M&A services are hands-on and holistic, tailored to your unique industry and transaction goals.

Buy-Side Support:

Target identification and qualification

Valuation modeling and financial analysis

Strategic fit assessments

Deal structuring and negotiation strategy

Integration planning and synergy analysis

Sell-Side Support:

Exit preparation and business readiness assessments

Financial and operational due diligence

Buyer profiling and outreach strategy

Deal structure design and term sheet negotiation

Transaction closing coordination

Why M&A Strategy Matters

M&A activity has the potential to accelerate growth, consolidate markets, or provide a well-earned exit. But it’s also fraught with risks: misaligned valuations, cultural clashes, post-deal integration issues, and regulatory hurdles.

That’s where we come in. GT Management helps you:

Identify the right targets or buyers

Conduct deep due diligence that protects your interests

Structure deals to optimize value and reduce exposure

Negotiate effectively with full context and preparation

Plan post-transaction integration for continuity and success

Who It's For

Our M&A advisory services are ideal for:

Founders preparing to sell their business

Corporations expanding through strategic acquisitions

Investors consolidating portfolio companies

Private equity firms evaluating new opportunities

Whether you’re navigating your first acquisition or managing a complex corporate merger, GT Management brings the clarity and capability you need.

How We Work

Discovery & Objective Setting: Understand your transaction goals and business landscape.

Valuation & Strategy: Analyze financials, market trends, and growth potential.

Transaction Execution: Support through negotiations, documentation, and regulatory compliance.

Integration & Post-Deal Support: Ensure the new structure operates smoothly and creates lasting value.

GT Management Services

Capital Raise Support

Securing funding is competitive — we position you to win. GT Management provides end-to-end capital raise support, ensuring you're fully prepared to pitch, negotiate, and close with investors.

Exit Strategy Planning

Your exit is one of the most critical financial events in your company’s journey. We help you plan proactively and strategically so that when the time comes, you're ready.

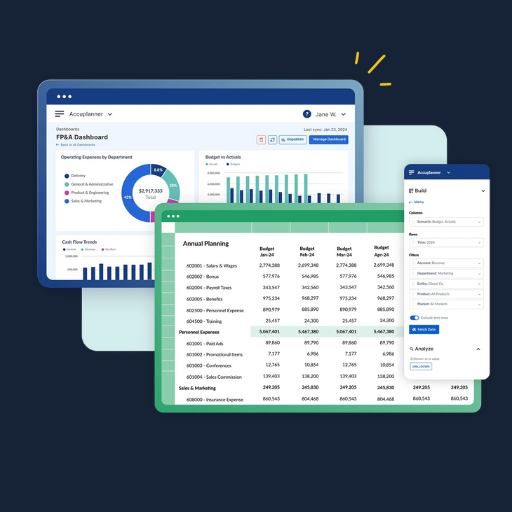

Financial Modeling & Forecasting

We build robust, fully-customized financial models that help founders, CFOs, and executives visualize current financial health and forecast future outcomes with clarity.

Governance & Compliance

Strong governance is the foundation of a sustainable, investment-ready company. We help you build compliant, transparent, and effective systems for accountability.

Compensation Modeling

Design compensation plans that balance business goals with employee motivation. Whether you're hiring C-level executives or scaling a sales team.

Partner with Experts Who Understand the Full Picture

We don’t just look at the deal—we look at your future. At GT Management, our M&A advisory services are built on deep financial insight, strategic foresight, and a commitment to your long-term success.

Schedule a discovery call today and learn how our M&A expertise can unlock your next chapter.