End-to-End Fundraising Support That Helps You Stand Out and Succeed

we understand how critical it is to secure the right capital at the right time. Whether you’re preparing for your seed round or seeking growth-stage funding, raising capital is one of the most challenging—and important—milestones a business can face. We’re here to make sure you’re not just another pitch deck in a pile.

Solution Focused

precision and results

Expericened Team

What We Offer

Our Capital Raise Support service provides a complete roadmap to get you investor-ready and confident. We work closely with your team to craft compelling materials, align your numbers with your story, and coach you through investor conversations.

Our Capital Raise Services Include:

Investor-Ready Pitch Decks: Visually powerful and strategically written to engage and persuade.

Financial Model Alignment: We ensure your financials back up your pitch with credibility.

Capital Strategy Planning: Identify how much to raise, when, and on what terms.

Investor Targeting: Build a curated list of VCs, angels, and strategic investors aligned with your goals.

Due Diligence Preparation: Organize your data room and anticipate investor questions before they’re asked.

Pitch Coaching: From delivery to objection handling, we make sure you’re ready to shine.

Why It Matters

Raising capital isn’t just about the money—it’s about relationships, readiness, and positioning. Investors want confidence, clarity, and a compelling story. Our process is designed to:

Improve your odds of getting funded

Shorten your fundraising timeline

Build investor trust from the first conversation

Help you negotiate terms with confidence

Whether you’re raising equity, debt, or venture capital, we position you to approach the market with authority.

Who It's For

Startups looking to raise pre-seed, seed, or Series A funding

Scaling companies preparing for Series B and beyond

Founders unsure of where to start with fundraising

Executives needing a polished investor narrative

If you’re facing a competitive capital market, GT Management helps you cut through the noise.

Our Process

Initial Discovery: We assess your goals, industry, and current investor materials.

Capital Strategy Session: Define how much to raise, what type of funding, and from whom.

Pitch & Financial Development: We build and align your pitch deck, financial model, and data room.

Investor Readiness Coaching: We simulate real investor Q&A and prepare you for the toughest questions.

Launch & Support: Whether you’re pitching live or virtually, we stay on standby to help you adjust materials and answer investor feedback.

GT Management Services

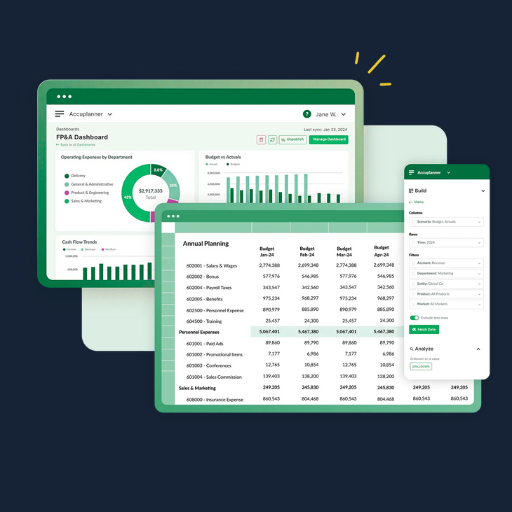

Financial Modeling & Forecasting

We build robust, fully-customized financial models that help founders, CFOs, and executives visualize current financial health and forecast future outcomes with clarity.

Exit Strategy Planning

Your exit is one of the most critical financial events in your company’s journey. We help you plan proactively and strategically so that when the time comes, you're ready.

Mergers & Acquisitions

GT Management supports both buy-side and sell-side M&A deals, providing thorough analysis, negotiation, and due diligence support.

Governance & Compliance

Strong governance is the foundation of a sustainable, investment-ready company. We help you build compliant, transparent, and effective systems for accountability.

Compensation Modeling

Design compensation plans that balance business goals with employee motivation. Whether you're hiring C-level executives or scaling a sales team.

Win the Capital You Need to Grow

At GT Management, we go beyond design and documents. We bring strategy, structure, and investor insight to every fundraising journey. You don’t just get a deck—you get a partner who’s committed to helping you raise smart.