Exit Strategy Planning. Proactive Exit Planning for Maximum Value and Smooth Transitions

We believe that planning for your exit should start long before the actual transaction. Whether you’re preparing for acquisition, IPO, management buyout, or generational transfer, your exit is a defining moment—and the right preparation can make all the difference.

We work with founders, CEOs, and boards to design thoughtful, customized exit strategies that align with business goals, personal aspirations, and market dynamics.

Solution Focused

precision and results

Expericened Team

What We Offer

We deliver comprehensive exit planning support that includes:

Exit Readiness Assessment: Analyze financial, operational, and strategic preparedness.

Valuation Optimization: Identify growth levers and improve key metrics that drive value.

Deal Structure Advisory: Navigate the pros and cons of various exit options—asset sale, stock sale, merger, IPO, and more.

Succession & Transition Planning: Ensure continuity in leadership and operations post-exit.

Stakeholder Alignment: Manage communications and expectations with investors, partners, and employees.

Due Diligence Support: Prepare documentation and infrastructure for a seamless transaction process.

Why Exit Planning Matters

An exit isn’t just an event—it’s a process. The stakes are high, and the decisions you make now can significantly impact your financial outcomes, legacy, and business continuity. Our goal is to help you:

Maximize company valuation before and during the exit process

Minimize tax exposure and transactional risks

Ensure operational readiness and leadership continuity

Position the business attractively to potential acquirers or successors

With GT Management guiding your exit, you can move forward with clarity, control, and confidence.

Who It's For

Our exit strategy services are ideal for:

Founders looking to sell or transition their business

Investors preparing a portfolio company for exit

Family-owned businesses navigating generational transfer

Companies anticipating strategic acquisition or merger

Whether you’re two years or two months away from a transaction, we can help set the stage for a successful exit.

How We Work

Strategic Discovery: Understand your long-term goals, timeline, and ideal outcomes.

Business Evaluation: Conduct a detailed assessment of your business’s current market position.

Action Plan Development: Create a roadmap to increase value and reduce deal friction.

Execution Support: Provide ongoing advisory through negotiations, diligence, and transition.

GT Management Services

Capital Raise Support

Securing funding is competitive — we position you to win. GT Management provides end-to-end capital raise support, ensuring you're fully prepared to pitch, negotiate, and close with investors.

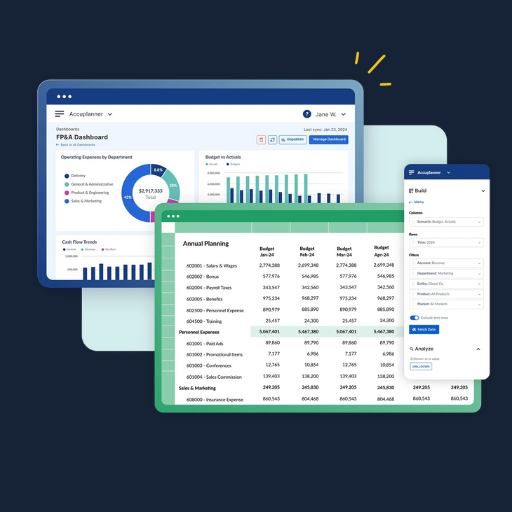

Financial Modeling & Forecasting

We build robust, fully-customized financial models that help founders, CFOs, and executives visualize current financial health and forecast future outcomes with clarity.

Mergers & Acquisitions

GT Management supports both buy-side and sell-side M&A deals, providing thorough analysis, negotiation, and due diligence support.

Governance & Compliance

Strong governance is the foundation of a sustainable, investment-ready company. We help you build compliant, transparent, and effective systems for accountability.

Compensation Modeling

Design compensation plans that balance business goals with employee motivation. Whether you're hiring C-level executives or scaling a sales team.

Start Planning Your Ideal Exit Today

The best exits don’t happen by chance—they’re the result of thoughtful preparation and expert guidance. At GT Management, we help you turn your exit into a strategic advantage, not a stressful scramble.